2022 Integrated Annual Report

General Contents

The organization and its reporting practices

Activities and workers

Gobernance

Strategy, policies and practices

Stakeholder engagement

SASB

Significant Contents

Disclosures on material topics

Economic Performance

Anti-competitive Behavior

Training and Education

Labor conditions and relations

Occupational health, safety and welfare

Ethics and anti-corruption

Consumption and energy efficiency

Water management

Materials

Consumer health, safety and welfare

Quality and safety in the value chain

Social assessment of suppliers

Transparency in product information

Innovation

Community engagement

SASB. Sustainability accounting standards

The Sustainability Accounting Standards Board (SASB) seeks to provide a common language between companies and investors of financially material impacts for every industry.

We are issuing this communication on the standards in the Processed Foods guide, which contains the following areas to be addressed:

- Energy management

- Water management

- Food safety

- Health and nutrition

- Product labeling and marketing

- Managing the life cycle of packaging

- Environmental and social impacts of supply of ingredients

- Supply of ingredients

| Matter | # | Description |

|---|---|---|

| Energy management | FB-PF-130a.1 | (1) Total energy consumed: 1,210,504 GJ (2) Percent of electricity from the network: 27.4% (3) Percent that is renewable: 49.5% |

| Water management | FB-PF-140a.1 | (1) Total water extracted: 1291.47 ML (2) Total water consumed, percent of each in areas with high or extremely high water stress: 530.67 ML San Luis Potosí: 24.1% State of Mexico (Zumpango): 7.5% Los Mochis: 55.6% Valle Celaya: 3.2% State of Mexico (Chalco): 1.3% Jalisco (Lagos de Moreno): 8.2% Tijuana: 0.02% Monterrey: 0.04% Jalisco (Guadalajara): 0.03% Mérida: 0.04% |

| FB-PF-140a.2 | Number of violations associated with permits, standards, and water quantity and/or quality regulations: 1 | |

| FB-PF-140a.3 | Description of water management risks and discussion of strategies and practices to mitigate those risks:

1. At Grupo Herdez, 99.9% of our operating facilities (plants, distribution centers, and administrative and/or corporate offices) are located in areas classified as having a “very high” or “high” degree of water stress, representing a combination of vulnerability, threat, and also an opportunity to plan and implement a water management program. 2. Grupo Herdez is heavily dependent on products from the agricultural sector (tomatoes, chilis, etc.) and raw materials whose production is dependent on other agricultural products (semolina, frozen strawberries, etc.). 3. To minimize these risks, we have developed several water reduction and savings projects at our plants and distribution centers, also recycling treated wastewater (to be used to irrigate green areas). Our objective at Grupo Herdez is to reduce water consumed per ton produced by 25% by the year 2030, compared to 2018 (base year), which is equal to consumption of 1.98 m3 per ton produced by 2030. This objective is in line with the following Sustainable Development Goals: The performance indicator is stated in intensity of water use, expressed as the volume of water (m3) per ton produced.

Historic water intensity Reduction in % The scope of water intensity includes the following plants: El Duque de Herdez Industrial Complex (Barilla, El Duque, and the cogeneration plant), Planta Coronel Espinosa, Planta México (Zumpango), Herdez San Luis Potosí (industries), Santa Rosa Tomates, Santa Rosa Vegetales, Herdez Villagrán, Planta Nutrisa, and Planta Lagos de Moreno. |

|

| Food safety | FB-PF-250a.1 | Audit of the Global Food Safety Initiative (GFSI) (1) Non-compliance rate: 5.63 (2) Rate of associated corrective action to: 4.1 (a) Major non-compliance events: 4.5 (b) Minor non-compliance events: 4.0 |

| FB-PF-250a.2 | Percent of ingredients from Level 1 provider facilities certified by a food safety certification program recognized by the Global Food Safety Initiative (GFSI) 76.46% |

|

| FB-PF-250a.3 | (1) Total number of notifications of food safety violations received: 1 (2) Percentage corrected: 100% |

|

| FB-PF-250a.4 | (1) Number of notifications issued: 0 (2) Total number of food products removed: 0 |

|

| Health and nutrition | FB-PF-260a.1 | Revenues from products labeled and/or marketed to promote health and nutritional benefits: $10,571,674 MXN |

| FB-PF-260a.2 | Discussion of the process to identify and manage products and ingredients related to nutritional and health concerns among consumers: HEALTH: There is a review of the ingredients that are in different products; the review is exhaustive to ensure compliance with applicable regulations, not only locally, but also to the country to which the product is exported. All labels on our products must comply with Official Mexican Standards (Normas Oficiales Mexicanas – NOMs) on labeling, and there is an initial review of ingredient compliance. NUTRITION: All products have nutritional information and a list of ingredients that provides information to the consumer, in compliance with the regulations in the country where the product is sold. Furthermore, according to epidemiological and health information issued by domestic institutions, at Grupo Herdez we have strategies that help decrease the impact of the Group’s products on consumer health. The most important strategy is applying “internal nutritional guidelines” to new developments. Those guidelines are below the maximum allowed by domestic regulation for non-alcoholic food and beverages. We are also always looking for ways to reduce and/or eliminate other potentially harmful and artificial substances from the existing portfolio. |

|

| Product labeling and marketing | FB-PF-270a.1 | Percent of advertising runs (1) Targeting children: 0 (2) Targeting children that promote products that comply with nutritional guidelines: 0 At Grupo Herdez there are currently no products that target children. Therefore, we do not have indicators that provide information on the daily nutritional recommendations for this age range, although there are products that are consumed by children. These are in the “all family” category and cannot be considered as food targeted at children. |

| FB-PF-270a.2 | Revenues from products labeled as: (1) Containing Genetically Modified Organisms (GMO): 0 (2) Non-GMO: 100 Grupo Herdez currently does not have a policy regarding use or restriction of ingredients that are, contain, or derive from Genetically Modified Organisms (GMOs), nor do we perform any type of analysis to establish the presence or absence of GMOs. However, and anticipating any request or requirement, whether domestic or international in matters of GMOs, we ask that raw materials suppliers provide a “GMO Letter” establishing whether the raw material derives from or contains Genetically Modified Organisms. Note that the products that we sell do NOT contain GMOs intentionally or deliberately, although there is a chance that some of the multiple raw materials that are used to develop our products might contain or derive from Genetically Modified Organisms. |

|

| FB-PF-270a.3 | Number of violations of marketing code and/or labeling or industry regulations: 1 | |

| FB-PF-270a.4 | Total amount of monetary losses as a result of legal proceedings associated with labeling and/or marketing practices: 0 | |

| Managing the life cycle of packaging | FB-PF-410a.1 | (1) Total packaging weight: 123,037.57 Ton (2) Percentage made of recycled and/or renewable materials: 29.21% (3) Percent that is recyclable, reusable and/or compostable: 98.12% |

| FB-PF-410a.2 | Discussion of strategies to reduce the environmental impact of packaging along the life cycle. 1. We have developed a Life Cycle Analysis (LCA) for the main product categories (salsas, mayonnaises, tea, avocado, Nutrisa® frozen yogurt, ice cream, pasta, tomato puree, green salads). The product most representative of the category has been selected, and the specific LCA developed in order to obtain more information. Some products have a third-party expert report called a “critical review.” 2. These LCAs were performed considering all stages of the life cycle (raw material, packaging material, including the transport of both, manufacturing, transport/distribution, use, and end of life). During the end-of-life stage we identify the environmental impacts of the packing and packaging materials, to perform a sustainability analysis to simulate scenarios of possible impacts in light of substantial future changes in: type, volume, recyclability, and rate of recycling increase, among others. 3. The preparation of these LCAs has led to other actions being taken in terms of circularity of packaging. This is the case in the pasta category, in which one of the main initiatives is to make sure that all packaging used is recyclable. |

|

| Environmental and social impacts of supply of ingredients | FB-PF-430a.1 | Percent of food ingredients that are certified according to third-party environmental and/or social standards.

Percentage per standard: 34 In 2022, 113,647 tons of agricultural raw materials (strawberries and frozen items) and honey were acquired, of which 38,850 tons come from suppliers that are part of the Program for Sustainable and Regenerative Agriculture (PASyR) of Grupo Herdez, which is 34% of all agricultural raw materials acquired. |

| FB-PF-430a.2 | Audit of social and environmental responsibility of suppliers.

(1) Non-compliance index: 43% Seventy-nine suppliers were evaluated, and 34 were rated under 60, with a 43% rate of non-compliance, according to their sustainability-related practices.

|

|

| Supply of ingredients | FB-PF-440a.1 | Percent of food ingredients from regions with high or extremely high water stress: 88 % Note 1: This percentage includes the acquisition of key inputs/raw materials from agricultural sources, bees, and manufactured products. Note 2: The report published on the Aqueduct Water Risk platform is used as the criteria for determining water stress, as it is an internationally recognized tool. |

| FB-PF-440a.2 | List of priority food ingredients and discussion of supply risks due to environmental and social considerations:

Ingredients: oil, starches and sweeteners, standard sugar, refined sugar, dry chilis, chili Guajillo, chilis, green jalapeno, jalapeno chili, fresh red Poblano chili, frozen strawberries, mole cookies, sweet yellow corn, clear honey from the highlands, clear honey from the coast, cactus, tomato paste, salt, semolina, tomatoes, tomatillo, and egg yolks. The strategic method for managing environmental and social risks is the Program for Sustainable and Regenerative Agriculture (PASyR), which consists of guiding, training, supervising, and following up on the production practices of our agricultural suppliers, with the goal of protecting and improving the environment, focusing particular attention on protected zones or areas, water use, soil protection, and air cleanliness. We have a team of internal auditors that evaluates and follows up on the condition of buildings. A ten-point checklist is used to measure the progress and areas for improvement at each supplier. At the end of the 2022 cycle (December 2022), 31 suppliers had been evaluated. We implement the PASyR through a ten-point checklist: In 2022, we began creating synergies with our semolina providers, encouraging sustainable agricultural practices in wheat producers. Positive results regarding these synergies are expected in 2023. |

|

| Activity | FB-PF-000.A | Weight of products sold: 597,387.50 Ton |

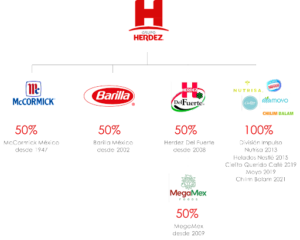

| FB-PF-000.B | Number of production facilities: 15 Grupo Herdez has 15 plants (14 in Mexico, and 1 in the United States). However, we do not operate the plants in Oaxaca, Coahuila, Querétaro, and Dallas directly, as we have a shareholder stake but no involvement in the day-to-day operation of those plants. Therefore, as we do not operate those plants we do not have the necessary information to present their sustainability indicators. |

IP-2. Social investment

We encourage food security in the communities where we operate, so that all people have access to sufficient, safe and nutritious food to meet their nutritional needs, while satisfying their cultural preferences for a healthy and active life.

Inclusion and Social Investment during 2022 was $ 90,909,120.79, equivalent to 4.0% of Net Income. This included the activities carried out by the Fundación Herdez through in-kind donations to the Asociación Mexicana de Bancos de Alimentos, A.C. (BAMX), the Saber Nutrir® program with donations to the Patronato Pro Mazahua A.C. and other Group projects with a social purpose such as the Programa Semillero Nutrisa®.

During 2022, 128 new projects were implemented, 44 new families and 1 community joined the program.

From 2013 to 2022, Saber Nutrir® (Knowing How To Nourish) has benefited 966 families in 35 communities with 2,071 projects.

86% of the projects are led by women.

Saber Nutrir

The amount invested by Saber Nutrir® in 2022 was $6,395,150.00 ($3,722,500.00 for Fundación Pro Mazahua; $2,200,000.00 for Fundación Crisalida Internacional A.C.; and $472,650.00 Strategik).

Estado de México

County of San José del Rincón

Marketing projects

Through 83 marketing projects implemented between 2019-2021 in Mazahua communities in Estado de México, profits of $5,106,010.00 were obtained in 2022 to benefit the economy of 169 families.

These projects consist of strawberry, tomato and nopal cactus greenhouses, modules for the production of poultry, sheep and pigs, as well as egg incubators.

Food safety

During 2022, thanks to food security projects such as microtunnels and chicken coops granted between the years 2013-2021, families saved and earned through sales of surplus $5,577.00 per month.

This represents a great support for the economy of these families, since in the region the average income is $4,000.00 per month for construction work, farm work and the sale of animals.

Nutritional surveillance

From 2013 to 2022 the percentage of children with malnutrition went from 65 to 45%. The normal nutritional status is 23 to 49%, overweight is 8 to 4% and obesity is 4 to 2% (51 children belonging to 34 families with project).

Yucatan

Counties of Muna, Santa Elena and Oxkutcab

- 4 communities (Choyob, Yax-ha, San Simón and Xohuayan)

- 87 families benefited in 2022 (Some beneficiaries since 2021, in total 106 families operating 169 projects since the beginning of the program in 2021).

- 87 projects installed by 2022: 17 farms, 15 vegetable gardens, 15 silos, 15 stormwater harvesting cisterns, 10 biodigester + purifier toilets and 15 ecological stoves.

Nutritional surveillance

From July 2021 to June 2022 the percentage of children with malnutrition went from 24 to 22%, normal nutritional status went from 36 to 35%, overweight from 17 to 21% and obesity from 23% to 22% (original sample of 111 children from 2021).

Jalisco

County of Lagos de Moreno

- 1 community (Santa Elena)

- 20 families

- 41 projects installed: 20 cisterns with stormwater harvesting systems and 21 vegetable gardens (20 family vegetable gardens and 1 school vegetable garden).

Nutritional surveillance

The baseline conducted in July 2022 found that 31% of 67 children were undernourished, 64% were in normal nutritional status, 2% were overweight and 3% obese.

In December 2022, the same 67 children were monitored again and 15% were found to be undernourished, 76% were in normal nutritional status, 6% were overweight and 3% obese.

In December 2022, the same 67 children were monitored again, and it was found that 15% suffer from malnutrition, 76% are in a normal nutritional state, 6% are overweight and 3% are obese.

Sponsor Program Saber Nutrir® (Knowing How To Nourish)

During 2022, 79 children with malnutrition in the Mazahua area of Estado de México benefited from the support of 47 sponsors, who made monthly contributions for the purchase of nutritional supplements that allowed them to improve their nutritional status. A total of 14% (11 children) recovered from malnutrition.

Germplasm Bank

The seed bank located in the Mazahua community “El Huizache” in Estado de México, currently has 425 seed samples of 31 species of corn, beans, fava beans, sunflower, quelite and chia. This project was possible thanks to the training and support of the Universidad Autónoma de Chapingo in 2013.

Fundación Herdez

Through the network of Banco de Alimentos de México (BAMX), we provide monthly food support to institutions that serve the food-poor population in Mexico. During 2022, we donated 1,851.9 tons of food.

For 35 years, Fundación Herdez has had the objective of promoting research, preservation, rescue and broadcasting of the rich heritage of Mexican gastronomy, our biodiversity, as well as our gastronomic traditions and the elements that make up our national identity, through the Biblioteca de la Gastronomía Mexicana and the Museo Galería Nuestra Cocina Duque de Herdez. As well as strengthening the educational and teaching processes with workshops held at the Interpretation Center.

During 2022, 3,283 visitors were guided through a tour of the Museo Galería Nuestra Cocina Duque de Herdez, the use of the documentary collection of the Biblioteca de la Gastronomía Mexicana was promoted with personalized attention to 704 users, with a collection of over 7,000 titles.

The Foundation trained 1,027 people through various academic and cultural events.

In addition, guidance was provided at the Interpretation Center in order to spread knowledge not only of the history and gastronomic traditions, but also nutritional knowledge to reinforce food education, with a focus on the “The Wellness Dish” (Food guide represented as a dish divided in three parts, each one representing a food group) to 349 people in tastings.

To the educational and training program of the new Fundación Herdez headquarters “Casa Doña María Pons” in San Luis Potosí, 208 people attended in the period April-December 2022.

The amount invested in Fundación Herdez: Donation Monthly food program through BAMX $ 73,897,720.99, and its food donation was 1,851,956.67 kilograms.

Donation of natural and special disasters $123,494.00 and the amount of food donated was 3,960.61 kilograms.

IP-7. Research and Development Management

Research and Development spending over the last 4 years has been as follows:

| Unit | 2020 | 2021 | 2022 | |

|---|---|---|---|---|

| Total R&D Expense | Millions of pesos (MXN) | $36,782,615 | $41,056,045 | $48,282,880 |

| Number of modified products | Quantity | 73 | 83 | 90 |

| R&D expenditure as % of sales | MXN EXPENSE / % OF NET SALES | 0.15% | 0.16% | 0.15% |

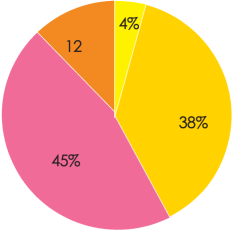

| Type of innovation | Percentage of revenues (in%) |

|---|---|

| Specify the average number of years after launch during which a product continues to be described as “new”. | 5 years |

| New products or services marketed during the last year | 4.82 |

| Significantly improved products marketed during the last year | 0.64 |

| Unchanged or minimally modified products or services | 94.5 |

| Total | 100 |

At Grupo Herdez strive to encourage open innovation, to contribute to external knowledge and to enhance our internal strategy.

IP-8. Policies and procedures to communicate to consumers

Consumers are exposed to a variety of processed foods through the expanding global marketplace. They may find these products attractive for reasons of convenience, cost, taste or improved health. To help these consumers make informed choices, information should be presented in different forms and media such as product labels, customer service hotlines and websites.

Measurement

The relevant regulatory labeling requirements for the product market depend on the product category. For the domestic market, the product-specific Official Mexican Standard (NOM) applies. If it does not exist, general regulations are applied, such as: Regulations on Sanitary Control of Products and Services; General Healthcare Law on sanitary control of activities, establishments, products and services; Agreement determining additives and adjuvants in food, beverages and food supplements, their use and sanitary provisions; Agreement determining prohibited or permitted plants for teas, infusions and edible vegetable oils; among others.

In the case of Exports products, the applicable regulations of the country to which the product is to be exported apply.

Nutritional and ingredient information

Review not only of the product itself, but also of the sub-ingredients of the raw materials included in the formula for evidence of any additives or contaminants that may affect the safety of the product.

We even request pollutant analysis results from some of our suppliers, depending on the nature of the ingredient or product, particularly for products exported to the USA and Europe.

All our products that fall into the categories of Food, Non-alcoholic Beverages and Dietary Supplements include the list of ingredients and the corresponding nutritional information.

For foods and beverages, the following must be included: energy content, protein, total fat, saturated fat, trans fat, available carbohydrates, total sugars, added sugars, dietary fiber and sodium per 100 g of product. As indicated in the AMENDMENT to the Official Mexican Standard NOM-051-SCFI/SSA1-2010, General labeling specifications for prepackaged foods and non-alcoholic beverages – Commercial and sanitary information.

In the case of food supplements, the following are included: energy content, protein, total fat, carbohydrates and sodium both per serving and per 100 g. As indicated in the Sanitary Control Regulations for Products and Services.

The primary source of nutritional information is the label. However, some of the company’s web pages include such information. In addition, the toll-free 800-customer service line of each of the Brands of food and non-alcoholic beverages has the corresponding updated information.

Within the internal guidelines of the department, it has been agreed to indicate on the label:

- Whether the colorant is artificial or natural

- Whether the flavor is natural, artificial or identical to the natural one. Hydrolyzed protein and MSG are declared as such.

- There is no GMO declaration policy in accordance with national legislation.

- Sweeteners are declared as required by the Additives Agreement.

- All allergens present and those that may be present in the product are declared.

- Virtually none of our products are fortified unless it is a regulatory requirement.

- The methods used in food processing to maintain food safety are indicated.

All representations made on labels must be supported by scientific evidence, in order to include them in the label, and they need to comply with the applicable regulations to the product and to the market in which the product is to be sold.

There is no actual report on the communication of ingredients and nutritional information to consumers

Percentage of total sales volume of consumer products that are reduced in saturated fats, trans fats, sodium or added sugars: 0.62

Percentage of total sales volume of consumer products that have been refurbished/reformulated: 4.82

The ingredients and nutritional information of each product are defined and declared in accordance with the applicable regulations in force. Even for those products that are exported to different countries.

In some cases, this information is verified with specialized agencies or with bromatological analyses in the country of destination.

Specific information on each ingredient is requested from the corresponding supplier. The information is reviewed for consistency and fed into a database that stores all nutritional information.

From this database, calculations are made for the nutritional information.

In addition, the ingredients are checked for subingredients or additives that are permitted according to the applicable regulations in force.

Once these revisions are completed, both the list of ingredients (in decreasing order of the formula) and the nutritional information are integrated either in table or in the format requested or permitted by the applicable regulation. They are then included in the labeling specification “Format of Legal Texts”.

417-3. Incidents of non-compliance concerning marketing communications

Grupo Herdez, S.A.B. de C.V., nor its subsidiaries have failed to comply with marketing communications in 2022.

417-2. Incidents of non-compliance concerning product and service information and labeling

In November 2022, the Secretariat of Health of the State of Jalisco conducted an inspection visit in an establishment of a supermarket chain (commercial partner of Grupo Herdez) located in Guadalajara. As a result of this visit, the authority determined that the labeling of certain products of the “tea” category of the “McCormick” brand showed legends that allegedly violated certain applicable health standards. Therefore, the authority immobilized these products. Grupo Herdez and its commercial partner are currently determining the legal actions to be taken.

417-1. Requirements for product and service information and labeling

All of our product labels comply with the Mexican Official Standards (NOMs) for labeling, which contain the requirements we must meet. An initial review of ingredient compliance is performed. The review of the ingredients, which make up the formula of the different products, is done exhaustively to ensure compliance with the applicable regulations, not only locally but also, if applicable, in the country to which the product is exported.

In the case of Mexico, the labeling is designed according to the:

- Regulation of Sanitary Control of Products.

- NOM-050-SCFI-2004: Commercial Information; General Product Labeling.

- NOM-051-SCFI/SSA1-2010: General Labeling Specifications for Prepackaged Foods and Non-Alcoholic Beverages – Commercial and Sanitary Information.

The organization’s procedures mandate that the origin of the product’s components must be disclosed and, if they have undergone any processing, their origin and safety must be declared. They also require that information on all critical substances such as colorants, additives for industrial use, among others, is provided. As well as to providing information on the safe use of the products, especially when they require instructions for consumption, handling and preservation, as well as the best-before and/or expiration date. At the same time, precautionary indications are included in case the product contains allergens or additives with side effects.

The review of the ingredients that make up the formula of the different products is carried out exhaustively to ensure their safety, quality and compliance with the applicable regulations. Not only locally, but also in the country to which it is exported.

With the “Empresa Socialmente Responsible” mark on the labels, the icon to deposit the container in the trash and the recyclability icon in the case of tetrapak.

414-2. Negative social impacts in the supply chain and actions taken

During 2022, we evaluated 108 suppliers in relation to social impacts.

We identified 4 suppliers with potential and actual negative social impacts, for each case we have a specific action plan. With 100% we have agreed on improvements, these suppliers will be re-evaluated in 6 months and if they obtain the same rating again, their disengagement will be evaluated.

414-1. New suppliers that were screened using social criteria

The evaluation of sustainable suppliers will be an ongoing process in collaboration with IKUS Solutions, a company focused on creating integrated solutions to improve decision making in the areas of Marketing, Purchasing, Quality and Operations.

In 2022, 108 suppliers were incorporated into the program, which were evaluated and selected according to social criteria.

IP-6. Agricultural Sustainability

Sustainable and Regenerative Agriculture Program

The program consists of guiding, training, supervising and monitoring the production practices of our agricultural suppliers, based on conservation, the regeneration of ecosystems and the sustainable development of communities. The purpose is that our agricultural products generate the least possible impact on the environment in order to favor the improvement of the environment and thus generate the least possible impact. This indicator pays special attention to protected zones or areas, the use of water resources, soil conservation and clean air. To achieve this, it has a set of criteria, indicators, actions and collaborative strategies between Grupo Herdez, suppliers and other collaborators.

This program is implemented through a compliance Ten-Point Framework:

- Biodiversity Preservation

- Air, water and soil protection

- Energy and climate change

- Waste management

- Integrated Crop Management

- Reduction of agrochemicals

- Safety and health

- Decent work

- Social responsibility

- Communication and participation

Program objectives:

Ensure that perishable (fresh) raw materials: red tomato, green tomato, chilies, cilantro, onion, nopal cactus and tea (lemongrass, chamomile and spearmint) as well as non-perishable and/or manufactured raw materials (e.g., corn, semolina, honey, strawberry, etc.) that adhere to the same, come from a Sustainable and Regenerative agriculture source.

The main benefits of this program are:

- To promote, encourage and develop sustainable agriculture as a new agricultural production culture among our suppliers.

- Reduce the use of pesticides to lower the environmental impact and promote the adequate management of agrochemicals (GUMA).

- Preserve the quality of soil, air and water in the cultivation zones and surrounding areas.

- Encourage practices to improve soil quality.

- Promote practices for the efficient management and use of resources, favoring reduction, reuse and recycling.

- Encourage the protection of sensitive or protected areas and species.

Audit

In order to give continuity and validity to the program, we have a team of internal auditors who evaluate and follow up on the status of the land property. This is done through a checklist, which measures the progress and improvement points of each supplier.

Suppliers

- Number of agricultural suppliers during the year: 31

- Number of suppliers evaluated during the year: 31

- Number of approved suppliers: 30

Of our total agricultural suppliers, the percentage of compliance with Good Use and Management of Agrochemicals is 94.2%, 4.2% higher than the previous year.

*Note: The program only covers suppliers of fresh raw materials, as a first stage, these are suppliers of onion, tomato, chili, cilantro, among others.

The main controls in place to monitor the progress of program implementation are as follows:

- Providing document control at the beginning of the contract. Periodicity:

- Periodic oversight of each supplier. Frequency:

- GAP Audits. Frequency:

- Water, soil and fruit analysis. Periodicity: water and soil, only once. Fruit, monthly.

- Frequency: monthly.

- Activity Reports of the Agricultural Auditors. Frequency:

Use of agrochemicals

The main method for the reduction in agrochemical use is under Integrated Crop Management (use of biological products), where the application of agroecological techniques, methods and resources aimed at strengthening crops is encouraged. This includes risk assessment, prevention and timely detection, to promote the balance of pests and predators. Agrochemicals are mainly replaced by:

| Fungicides | Use of organic fertilizers and beneficial microorganisms |

|---|---|

| Insecticides | Use of beneficial fungi, bacteria and insects |

| Fertilizers | Use of organic fertilizers (compost, leachates, ratooning) |

Monitoring controls

The monitoring controls are based on our Sustainable and Regenerative Agriculture Program and are documented under the Good Agricultural Practices, complying with various indicators whose bibliographic basis is found in the following listed documents and annexes:

The monitoring controls are carried out by means of the agricultural audit follow-up log, which contains the following formats:

- PDTEC-232-28 Supplier Management Procedure for Agricultural Raw Materials

- MDTEC-232-05 Manual of Sanitary Agricultural Practices (GAP, GUMA)

- MA-DTEC-232-06 Agricultural Auditor Manual

- IDTEC-232-28-01 Field sampling for analysis of fruit, water and soil for contaminant analysis

- FDTEC-232-28-00 GMO Declaration.

- FDTEC-232-28-01 Agricultural Logbook Receipt Letter.

- FDTEC-232-28-02 Agricultural Area Directory.

- FDTEC-232-28-03 Supplier’s General Data and location of the property.

- FDTEC-232-28-04 Property Background.

- FDTEC-232-28-05 Agrochemical reception.

- FDTEC-232-28-06 Logbook of Chemical, Biological and Organic Applications.

- FDTEC-232-28-07 Fertilizer, nutrients, regulators and irrigation application control.

- FDTEC-232-28-08 Audit of Good Practices in the preparation of mixtures and application of agrochemicals.

- FDTEC-232-28-09 Field Visit Report

- FDTEC-232-28-10 Sampling for Contaminants

- FDTEC-232-28-11 Certificate of Origin

- FDTEC-232-28-12 Vulnerability to Food Fraud, Agricultural Supplier Risk Level and Performance

- FDTEC-232-28-13 Agricultural Follow-Up Program

- FDTEC-232-28-14 Harvest Record

Periodicity of Verification

According to the risks assessment and performance of each supplier, the frequency with which the corrective actions required based on the first evaluation to achieve the certification of Grupo Herdez will be verified and evaluated is established. This frequency can be weekly, biweekly, or monthly.

Training

We have provided more than 2,500 work-hours of training, generated changes in the sustainable culture of our suppliers and collaborators through indicators, actions and strategies, and various criteria implemented through:

Training and consulting, in which knowledge is transmitted and developed, on topics such as:

- Good Agricultural Practices (GAP).

- Good Use and Management of Agrochemicals (GUMA).

- Integrated Crop Management (ICM).

- Sustainability Criteria (Biodiversity, Climate Change, others)

- Training of trainers.

- Evaluation of results

Program results

- More than 2,500 work-hours of training have been provided.

- Reduction in the use of chemical pesticides (The supplier Octavio Mendoza Vázquez avoided the consumption of 4,400 liters of agrochemicals per year, Agro-productos Zubia in three years stopped using 5,602.5 liters of pesticides in an area of 100 hectares).

- Reduction in pesticide analysis in Finished Product (FP),

- Hazardous waste (HW), non-hazardous waste (NHW) and organic waste recycling

- Increased use of biological products in the field (adhering to the program through intensive use of beneficial insects has brought savings and has contributed to environmental care by generating less polluting waste).

Higher quality Finished Product (opening of new markets, Grupo Herdez has strengthened its presence in the world and has expanded its exports of sauces to Europe).

409-1. Operations and suppliers at significant risk for incidents of forced or compulsory labor

Our Supplier Code of Conduct contains the minimum guidelines that our current and potential suppliers must comply with regarding social and environmental conditions for the development of their operations and services.

This document is based on the standards of the International Labor Organization (ILO), the ten principles of the United Nations Global Compact, the Human Rights Policy and the Code of Ethics of Grupo Herdez.

408-1. Operations and suppliers at significant risk for incidents of child labor

We have a strict control in our contracting processes, as well as a Supplier Code of Conduct, which each supplier must sign when establishing a commercial relationship with Grupo Herdez.

The Code establishes clauses that prohibit the hiring of child labor or forced labor. This is a measure to avoid the risk of employing child labor throughout our value chain, especially in the most vulnerable sectors such as agriculture and fishery.

The Supplier Code of Conduct is available at: https://grupoherdez.com.mx//wp-content/ uploads/2021/09/Codigo-de-Conducta-de-Proveedores-GH-25.junio_.2021-VF.pdf.

204-1. Proportion of spending on local suppliers

| Supplier | Domestic | Foreign |

|---|---|---|

| Raw Materials | $7,960,191,609.87 | $791,121,179.00 |

| 91.00% | 9.00% | |

| Packaging Material | $3,906,666,314.38 | $112,446,183.89 |

| 97.20% | 2.80% | |

| Agricultural raw material | $1,059,265,325 | 0 |

| 100% | 0% |

Amounts expressed in Mexican pesos

Note:

Local or domestic purchases are defined as those suppliers that have their place of manufacture in Mexico.

The main origin of soybeans is the United States; however, the refining process to the final product that we receive, which is Soybean Oil, is carried out in Mexico.

All of our agricultural producers have operations in Mexico, distributed nationwide the Mexican Republic in the States of Aguascalientes, Baja California, Baja California Sur, Campeche, Chihuahua, Ciudad de México, Durango, Guanajuato, Hidalgo, Yucatán, Morelos, Nayarit, Nuevo León, Puebla, Quintana Roo, San Luis Potosí, Sinaloa, Sonora, Veracruz and Zacatecas.

IP-9. Health and Nutrition Care Strategy Development

Within the Technical Department, the Scientific and Regulatory Affairs Department validates that the products developed within Grupo Herdez contain permitted ingredients and, in the dosage, indicated by the applicable regulation for each product category. It also determines the nutritional icons that must appear on the front labeling, so that the consumer has the nutritional information provided by the product.

We continue to strengthen the internal nutritional criteria within the nutritional guidelines for the development of new products for the entire Group, creating categories and their corresponding nutritional criteria, indicating the maximum content limits for added critical nutrients and specific indications that must also be taken into account and/or must be complied with.

During this year, the total sales volume of consumer products low in saturated fats, trans fats, sodium and added sugars was 0.62%.

The total sales volume of renovated or reformulated products in 2022 is 4.8%.

The company has an advisory panel on nutrition and healthcare, as well as R&D centers focused on healthcare and nutrition.

Measurable nutrition criteria of “Healthy Nutrition” in product innovation:

- We continue to strengthen and monitor the applicability of internal nutritional criteria for new products throughout the Group.

- New categories are being created with their respective nutritional criteria (these categories include maximum content limits for critical nutrients and specific indications).

- By the year 2022, the number of partially hydrogenated fats was added to the internal nutritional criteria.

- We continue to monitor new products, innovations, reformulations, discontinued and cancelled products to improve their nutritional profile.

- The Nutritional Panorama of the food and beverage portfolio continues to be updated, including line products, innovations, reformulations and new products throughout the group, seeking to detect critical nutrients that will subsequently be evaluated so that, if necessary, they can be reduced.

Defined criteria for measuring nutrition

- Measurement is made through compliance with internal nutritional criteria. These regulate that new products do not exceed the recommendations guided by national and international regulations.

- The application of these guidelines is reflected in internal documents that serve as guidelines and evidence until the product is ready for sale.

The criteria defined to measure the progress of “healthy nutrition” in existing products:

- Follow-up on nutritional mapping, understanding the impact of the change in regulation on the number of warning seals on each formula.

- Impact analysis for artificial preservatives, sweeteners and flavorings.

- Identification of critical nutrients that represent the addition of warning seals.

- Implementation of reformulation actions aimed at reducing the number of seals on products.

The purpose of the nutritional mapping was to understand the number of warning seals on each formula, seeking the possibility of reducing critical added nutrients or reducing the number of warning seals. In addition, work began on identifying products with the possibility of reducing sodium, sugars and saturated fat. We also looked for technology to make a cleaner label.

Grupo Herdez also works with the innovation and research areas to comply with internal nutritional criteria for new or innovative products. On the other hand, we work with the aforementioned areas together with the sensory evaluation area to work on the reformulation of line products and direct them towards compliance with the nutritional criteria established after their launching.

416-2. Incidents of non-compliance concerning the health and safety impacts of products and services

As a result of inspection visits made by the Secretariat of Health to several retail establishments of Grupo Herdez, this authority determined that Promociones Inmobiliarias Naturistas S.A. de C.V. allegedly failed to comply with certain health, hygiene and water quality standards.

Promociones Inmobiliarias Naturistas S.A. de C.V. exhausted the corresponding administrative procedures, resulting in the issuance of warnings and the payment of a penalty in one of the cases.

416-1. Assessment of the health and safety impacts of product and service categories

100% of the product portfolio, both domestic and exports, are evaluated in terms of health and safety to promote improvements:

On health matters:

- 21.6% of the portfolio of domestic products are of a better nutritional quality. This percentage is represented by products that do not contain added critical nutrients (sugars, sodium, saturated fats) and by products that had some reformulation in added critical nutrients.

- 3% of the domestic product portfolio was reformulated to improve the nutritional profile, eliminating or reducing the content of added critical nourishments (sugars, sodium, saturated fat), and eliminating sweeteners.

From product design, selection of raw materials and packaging materials, we perform a risk assessment according to the market in which the product will be marketed, and based on this, the specifications and limits to be met are established. In addition, external audits are conducted to obtain FSSC22K certification.

All new and existing products have the conformity of their specifications to National Quality and Official Standards, as well as to CFR, FDA and USDA Export Standards, as applicable.

308-1. New suppliers that were screened using environmental criteria

We have a supplier sustainability assessment process, but it is performed on current suppliers, not new ones.

301-3. Reclaimed products and their packaging materials

We do not currently measure the exact amount of recovery. In the case of PET, recovery is done through the strategies and programs of a third party that calculates an estimate of the recovery of plastic containers that circulate nationwide and that they recover.

98.1% of our packaging is recyclable and/or reusable, which means 120,729 tons. Of these, 72,540 metric tons of glass, 13,672 metric tons of pallets, 12,672 metric tons of corrugated packaging and 8,545 metric tons of metal cans stand out.

301-2. Recycled input materials used

In Grupo Herdez we are starting our path into circularity and working on specific initiatives to achieve our goals for 2025. On the subject of recycled inputs, the materials that contain them are derived from corrugated cardboard such as boxes, crates and trays.

| Recycled materials 2019 | = | 2.59 |

| Recycled materials 2020 | = | 2.24 |

| Recycled materials 2021 | = | 13.74 |

| % Recycled materials 2022 | = | 10.25 |

The percentage indicated shows the percentage of post-consumer material recovery and is declared by supplier, not counting what is recycled as reprocessing due to waste. e.g.: manufacture of glass packaging or plastic packaging.

301-1. Materials used by weight or volume

In 2022 we consumed materials within 3 categories: agricultural raw materials, non-perishable raw materials and packaging materials (non-renewable and renewable).

Agricultural raw materials: 124,887.23 Tn

Raw materials: 316,658.09 Tn

Packaging Material: 123,037.57 Tn

- Renewable: 35,935.52 Tn

- Non-renewable: 87,102.05 Tn

306-5. Water bodies affected by water discharges and/or runoff

| Type of waste | |

|---|---|

| Hazardous waste | 50.83 |

| Special handling waste | 1,936.81 |

| Non-hazardous waste | 4,956.66 |

| Total waste | 6,944.15 |

Notes:

- Data on waste generation, recycling and/or disposal are reported to the environmental sustainability department through pre-established forms which are sent by the Manufacturing Plants and Distribution Centers.

- The method of waste disposal and/or recovery depends on the type of waste being generated and the technologies and recycling opportunities that exist in the local, regional and national market.

306-4. Transport of hazardous waste

| Waste recycling (Tn) | |

|---|---|

| Hazardous waste | 13.67 |

| Special handling waste | 4,145.36 |

| County solid waste | 33,192.93 |

| Total waste recycled | 37,351.96 |

Recycled hazardous waste: 13.67 Tn Recycled non-hazardous waste: 37,338.29 Tn

The reported data are measured volumes weighed on scales (taras) belonging to the Manufacturing Plants and Distribution Centers, which are continuously calibrated. The volumes are recorded in output notes, internal control records and reporting manifests that are delivered to various government agencies or are managed as internal control records.

Notes:

- Effluents are NOT included in the waste data reported as they are considered wastewater and are reported in the water section.

- Data on waste generation, recycling and/or disposal are reported to the environmental sustainability area through pre-established forms which are sent by the Manufacturing Plants and Distribution Centers.

- The method of waste disposal and/or recovery depends on the type of waste being generated and the technologies and recycling opportunities that exist in the local, regional and national market.

306-3. Significant spills

This year we generated 44,296.25 tons of hazardous and non-hazardous waste, 3% less than last year.

The breakdown is as follows:

- Total hazardous waste: 64.50 Tn.

- Hazardous waste recycled: 13.67 Tn.

- Hazardous waste sent to controlled final disposal: 50.83 Tn.

- Total non-hazardous waste 44231.75 Tn.

- Recycled non-hazardous waste 37338.29 Tn.

- Non-hazardous waste sent to landfill 6893.46 Tn.

Total weight of waste generated during the last 4 years

| Unit | 2022 | 2021 | 2020 | 2019 | |

|---|---|---|---|---|---|

| Waste generated | Metric tons | 44,296 | 45,515 | 34,594 | 42,045 |

Grupo Herdez has a general classification of waste into 3 main groups (hazardous waste, special handling waste and urban solid waste), which is mainly due to the Mexican federal, state and/or county legal framework and to the segregation that our Manufacturing Plants and Distribution Centers make of the waste for its better control, management and handling.

Effluents are NOT included in the waste data reported as they are considered wastewater and are reported in the water section.

306-2. Waste by type and disposal method

Some of the actions to prevent the generation of waste in the organization’s upstream and downstream activities or manage the significant impacts of waste generated. For example, in relation to post-industrial waste generated and reported in Indicators 306-3, 306-4 and 306-5, the main actions for the management/mitigation of impacts are:

- Identification of all waste generated at each facility.

- Physical and chemical characterization – in accordance with regulations and with certified laboratories in Mexico – of the waste that so requires (mainly hazardous waste and “non-hazardous” special handling waste), in order to obtain an official technical report on the hazardousness or non-hazardousness of the waste in question.

- Waste is categorized into hazardous and non-hazardous, and within the latter classification it is subdivided into special handling waste and county solid waste. Likewise, regardless of whether the waste is hazardous or not, it is also subclassified into recycled and non-recycled. Non-hazardous waste includes waste for fiscal destruction, which may contain organic and inorganic waste that can be recycled and non-recycled, depending on the recovery conditions of the waste and the recycling options available in the local, regional or national market.

- Recording of waste with the corresponding environmental authorities (county, state and federal) as applicable to the type of waste,

- Periodic recording of the generation of each waste generated by each of the Group’s facilities.

- The determination of the final management to be given to each waste according to its hazardous and non-hazardous characteristics, recycling, composting and final disposal in sanitary landfills or controlled confinement sites.

- The reuse or reincorporation into our own operational chain of materials that can be returned prior to their generation as waste and their management with external service providers, for example cardboard boxes or plastic buckets that are used within the facilities for other operations and that are no longer registered as waste unless such re-incorporation is no longer viable in our own operations.

- The selection of authorized suppliers (according to the corresponding legal authority) for the handling, transportation, recycling and/or final disposal of waste.

- The determination of the viability of each waste for its recovery and recycling according to the technological and cost options that exist in the market, as well as according to the environmental and, if applicable, social benefits that could be generated.

- Reporting to the corporate and the various stakeholders on the volumes and types of waste generated and recycled.

Post-consumer materials

Grupo Herdez has a collaboration agreement with ECOCE (a non-profit industrial association that has a management/neutrality plan for post-consumer materials), to which it reports the tons of PET released into the market via our products so that ECOCE, through its recovery strategies and programs, can channel these materials to collection and recycling centers.

Grupo Herdez ensures that waste management by third parties is performed in accordance with contractual or legislative obligations. For example, service providers are selected on the basis of the waste they will handle and particularly supervising at all times that suppliers are in full compliance with all applicable federal, state and/or county legal requirements at all times. First, technical visits are made to their offices to verify their documentary compliance with the framework that applies to them and to their facilities to ensure regulatory compliance and also to ensure that their technical operating conditions are adequate to ensure efficient and proper waste management, minimizing the risks of leaks, spills or problems that may lead to negative impacts on the environment and the surrounding community.

Processes used to collect and control waste data:

- The data reported are measured volumes weighed on scales belonging to the Manufacturing Plants and Distribution Centers. These volumes are recorded in output notes, internal control records and/or reporting manifests that are delivered to various government agencies or are managed as internal control records.

- Waste information is reported to the environmental sustainability area by the Manufacturing Plants and Distribution Centers through pre-established forms which are sent.

306-1. Water discharge by quality and destination

In Grupo Herdez the main inputs are agricultural products, manufactured products -soybean oil, semolina, etc.- and packaging materials -carton, glass, PET, etc.-.

In much smaller quantities, some chemical products are used – pure or compound substances – which are used for maintenance activities, laboratory analysis, quality and safety, cleaning of equipment and facilities whose chemical risk levels are sought to be as low as possible.

In the use of all of the above, the significant impact is the generation of non-hazardous and hazardous waste.

-the majority of these wastes are managed and handled in such a way that they are channeled into recycling chains in order to minimize their negative impact on landfills and landfill centers. This has allowed us to recycle 100% of the post-industrial waste generated. During 2022 we recycled 84.3% of the waste generated.

*Note: The wastes reported in sections 306-3, 306-4 and 306-5 are related to the operations of our Manufacturing Plants and Distribution Centers and are, therefore, considered post-industrial wastes (generated by our industrial processes). At no time do they refer to upstream or downstream waste.

303-5. Water consumption

The volume of stormwater collected and stored annually is 76 megaliters, corresponding to the maximum installed capacity.

| Source | Volume Total | Volume in water-stressed areas | Volume Total | Volume in water-stressed areas | Volume Total | Volume in water-stressed areas |

| Rivers and Lakes | 253.08 | 253.08 | 231.81 | 231.81 | 217.37 | 217.37 |

| Wells | 269.01 | 269.01 | 273.48 | 273.48 | 310.39 | 310.39 |

| County network | 0 | 0 | 3.53 | 3.53 | 4.4 | 4.4 |

| Others | 8.58 | 8.58 | 5.85 | 5.85 | 6.16 | 6.16 |

| Total | 530.67 | 530.67 | 515 | 515 | 538 | 538 |

Total water consumption, in megaliters, per facility in water-stressed areas

| Source | Barilla Manufacturing Plant | El Duque Manufacturing Plant | Mexico Manufacturing Plant | Industrial Manufacturing Plant | Santa Rosa Tomates Manufacturing Plant | Santa Rosa Vegetales Manufacturing Plant | Villagrán Manufacturing Plant | Nutrisa Manufacturing Plant | Lagos Manufacturing Plant | Cogeneration Plant | Té Manufacturing Plant | CAF Lagos |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Rivers and Lakes | 204.21 | 48.87 | ||||||||||

| Wells | 32.91 | 5.05 | 41.3 | 107 | 6.08 | 61.96 | 14.58 | 0.13 | ||||

| County network | ||||||||||||

| Tank truck water | 8.58 | |||||||||||

| Total | 530.67 |

Notes:

- Reported consumption is measured directly by measuring instruments that are monitored and some are certified by federal, state and county authorities. These consumptions are reported to these authorities through various formats and reporting mechanisms.

- The volume of stormwater is an estimated volume of what the Duque de Herdez Complex, Mexico Manufacturing Plant and Mexico Distribution Center recover and use for landscape irrigation.

- Since we are not using stormwater in our production processes, it will be reported separately.

303-3. Water withdrawal

Total water extraction from freshwater (1000 mg/L): 1,290.62

| Source | Total Volume (ML) | Water-stressed areas | Total Volume (ML) | Water-stressed areas | Total Volume (ML) | Water-stressed areas |

| Rivers and lakes | 717.46 | 717.46 | 737.8 | 737.8 | 702 | 702 |

| Underground (wells) | 543.74 | 543.21 | 531.92 | 531.42 | 537 | 537 |

| Seas and oceans | – | – | – | – | ||

| County network | 14.07 | 14.07 | 11.31 | 11.31 | 256 | 256 |

| Stormwater | – | – | – | – | – | – |

| Wastewater from another organization | 0 | 0 | 0 | 0 | 0 | 0 |

| Other (tank trucks) | 16.2 | 16.2 | 13.9 | 13.9 | 47 | 47 |

| Total | 1,291.47 | 1,290.94 | 1,295 | 1,294 | 1,542 | 1,542 |

Methodology used:

- Reported consumption is measured directly by measuring instruments that are monitored and certified by federal, state, and county authorities. These consumptions are reported to these authorities through various formats and reporting mechanisms. A 90% representation is considered because it does not include the water consumption of Nutrisa, Lavazza and Cielito Querido Stores, Moyo, Chilim Balam, or other facilities (offices, etc.).

- Although Grupo Herdez has facilities that collect stormwater, these are not reported because most of the volume collected is discharged into the environment and only a portion is used to irrigate green areas; therefore, the water is not stored and is not used in processes or services.

- In order to determine the water stress zones, the Water Statistics issued by the National Water Commission (Comisión Nacional de Agua or CONAGUA), information on availability zones according to the Basin and Aquifer of the country were used as reference sources. The Aqueduct Water Risk Atlas 2019 was also considered as a criterion for determining water stress, since it is an internationally recognized tool, with the exception of Mérida Distribution Center, where the CONAGUA criterion was considered because it was deemed to be closer to the country’s reality.

Note: This report includes the Barilla, McCormick SLP (El Duque), McCormick México (Cuautitlán), Herdez San Luis Potosí, Santa Rosa Tomates, Santa Rosa Vegetales, Herdez Celaya (Villagrán), Nutrisa, Lagos de Moreno (ice cream), Coronel Espinoza y Cogeneration, as well as the Distribution Centers of Tijuana, Monterrey, San Luis Potosí, Guadalajara, México (Cuautitlán), Mérida, Los Mochis y CAF Lagos de Moreno; Mérida Distribution Center is the only facility located in a low water stress zone.

Only the Tijuana and Mérida Distribution Centers are located in areas where the water quality is considered slightly brackish with TDS amounts greater than 1,000 mg/l; the rest of the facilities are located in areas with water considered fresh water because they contain TDS and/or TSS concentrations of less than 1,000 mg/l.

Total water withdrawal, in megaliters, per facility in water-stressed areas

| Source | Installation (Manufacturing Plants or Distribution Centers) | Volume 2022 | Volume 2021 | Volume 2020 | Volume 2019 |

|---|---|---|---|---|---|

| Rivers and lakes | Santa Rosa Tomates | 439.13 | 460 | 403 | 366 |

| Santa Rosa Vegetales | 275.81 | 477 | 298 | 300 | |

| Distribution Centers Mochis | 2.53 | 1.4 | 1 | 2 | |

| Underground (wells) | Barilla | 41.15 | 40 | 51 | 47 |

| El Duque | 38.51 | 38 | 41 | 41 | |

| Manufacturing Plants Mexico | 89.5 | 81 | 76 | 77 | |

| San Luis Potosí Manufacturing Plant | 202.06 | 193 | 201 | 259 | |

| Villagrán Plant | 41.94 | 36 | 28 | 39 | |

| Lagos de Moreno Plant | 99.1 | 110 | 111 | 129 | |

| Manufacturing Plants Cogeneration Plant | 14.58 | 16 | 15 | 0 | |

| Té Manufacturing Plant | 2.54 | 2 | 0 | 0 | |

| San Luis Potosí Distribution Center | 6.27 | 7 | – | – | |

| Mexico Distribution Center | 7.6 | 9 | – | – | |

| County network | San Luis Potosí Distribution Center | 6.11 | 2.25 | 9 | 7 |

| Mexico Distribution Center | 0 | 0 | 4 | 4 | |

| San Luis Potosí Manufacturing Plant | 0 | 0.23 | 1 | 0 | |

| Té Manufacturing Plant | 0.45 | 0.49 | 1 | 0 | |

| Guadalajara Distribution Center | 0.33 | 0.61 | – | – | |

| Tijuana Distribution Center | 0.32 | 0.31 | – | – | |

| Monterrey Distribution Center | 0.57 | 0.5 | – | – | |

| CAF Lagos | 6.3 | 6.92 | – | – | |

| Other (Tank truck and wastewater) | Nutrisa | 16.2 | 0.98 | ||

| Total | 1,290.94 | 1,295 | 1,542 | 1,299 |

303-2. Management of water discharge-related impacts

The minimum regulatory and/or internal standards for effluent discharge quality that the Manufacturing Plants and Distribution Centers follow are:

Biochemical Oxygen Demand (BOD)

Total Suspended Solids (TSS)

Total Dissolved Solids (TDS)

Sedimentable Solids (SS)

Potential Hydrogen (PH)

Electrical Conductivity (EC)

Temperature (°C)

Fats and Oils (F&O)

Chemical Oxygen Demand (COD)

Specific standards:

NOM-001-SEMARNAT-1996/ NOM-001-SEMARNAT-2021: Establishes the maximum permissible limits for pollutants in wastewater discharges into national waters and property.

NOM-002-SEMARNAT-1996: Establishes the maximum permissible limits of pollutants in wastewater discharges to urban or county drainage systems.

State Technical Mandatory Standard: NTE-SLP-AR-001/05, which establishes special conditions for wastewater discharge to the drainage and sewage systems of the Counties of San Luis Potosí, Soledad de Graciano Sánchez and Cerro de San Pedro.

Particular Discharge Conditions: established by Federal authorities pursuant to Article 140 of the Regulations to the National Waters Law (Ley de Aguas Nacionales).

303-1. Interactions with water as a shared resource

Extraction

| Source | Method of Extraction | Location and Name of Water Body | Description of Related Impacts |

|---|---|---|---|

| Rivers and lakes | Pumping | 1 at Canal Lateral 18+420 del Canal Valle del Fuerte, Cuenca (Basin) Río Fuerte, Afluente canal principal Valle del Fuerte Distrito de Riego 075, Región Hidrológica (Water Region) Sinaloa, Localidad El Fuerte, Sinaloa. | Possible depletion of the resource, although of low probability due to low extraction volumes. |

| 1 at Canal Lateral 18+420 del Canal Valle del Fuerte, Cuenca (Basin) Río Fuerte, Región Hidrológica (Water Region) Sinaloa, Localidad Campo 35, Ahome, Sinaloa. | Possible unavailability of the resource, with medium probability of occurrence due to transition risks (legal and/or social). | ||

| Seas and oceans | Not Applicable | Not Applicable | Not Applicable |

| Underground (wells) | By submersible pump | 2 at Cuenca (Basin) Presa San José Los Pilares y Otras, Acuífero (Aquifer) San Luis Potosí, Región Hidrológica (Water Region) Salado en SLP San Luis Potosí. 1 at Cuenca (Basin) Laja, Acuífero (Aquifer) Valle de Celaya, Región Hidrológica (Water Region) Lerma-Santiago, Villagrán Guanajuato. 1 at Cuenca (Basin) Río Verde Grande, Acuífero (Aquifer) Lagos de Moreno, Región Hidrológica (Water Region) Lerma-Santiago, Lagos de Moreno, Jalisco. 1 at Cuenca (Basin) Río Moctezuma, Acuífero (Aquifer) Cuautitlán- Pachuca, Región Hidrológica (Water Region) Pánuco, Localidad Barrio de San Juan, Teoloyucan, State of Mexico. | Possible depletion of the resource, although of low probability due to low extraction volumes in the case of San Luis Potosí, Guanajuato, Jalisco and Estado de México.

Possible unavailability of the resource, with medium probability of occurrence due to transition risks (legal and/or social). |

| County network | For direct mains supply | 1 at San Luis Potosí, SLP 1 at Tijuana, Baja California 1 at Monterrey, Nuevo León 1 at Tlaquepaque, Jalisco 1 at Lagos de Moreno Jalisco |

Possible depletion of the resource, although of low probability due to low extraction volumes.

Possible unavailability of the resource, with medium probability of occurrence due to transition risks (legal and/or social). |

| Storm water (collected and stored directly by the organization) | For infrastructure of canals and stormwater training pits | 1 at Complejo Industrial Duque de Herdez in SLP, San Luis Potosí 1 at Complejo Industrial Herdez México in Cuautitlán, Estado de México. |

Possible unavailability of the resource, with a medium probability of occurrence due to a decrease in rainfall. |

| Wastewater from another organization | Not Applicable | Not Applicable | Not applicable |

| Tank truck water | Direct supply by tank truck | 1 at the County of Chalco, Estado de México. | Possible depletion of the resource and a possible water deficit in the region. Likewise, extraction volumes are relatively low. |

Consumption

| Source | Use of extracted water | Location where it was consumed | Description of Related Impacts |

|---|---|---|---|

| Rivers and lakes | Industrial (Production, ancillary services and sanitary services) | 2 en Los Mochis Sinaloa. | Posible agotamiento del recurso, aunque de baja probabilidad por los bajos volúmenes de extracción.

Posible no disponibilidad del recurso, con probabilidad media de que ocurra debido a riesgos de transición (legales y/o sociales). |

| Seas and oceans | Not Applicable | Not Applicable | Not Applicable |

| Underground (wells) | Industrial (Production, ancillary services and sanitary services) | 1 in Cuautitlán, Estado de México. 3 in San Luis Potosí. 2 in Lagos de Moreno 1 in Villagrán Guanajuato. |

Possible depletion of the resource, although low probability due to low extraction volumes. Possible unavailability of the resource, with medium probability of occurrence due to transition risks (legal and/or social). Posible no disponibilidad del recurso, con probabilidad media de que ocurra debido a riesgos de transición (legales y/o sociales). |

| County network | Industrial (Production, ancillary services and sanitary services) | 1 in San Luis Potosí, SLP

1 in Tijuana, Baja California 1 in Monterrey, Nuevo 1 in Tlaquepaque, Jalisco 1 in Lagos de Moreno |

Possible depletion of the resource, although low probability due to low extraction volumes. Possible unavailability of the resource, with medium probability of occurrence due to transition risks (legal and/or social). |

| Storm water (collected and stored directly by the organization) |

Industrial (irrigation of green areas) | 2 in Cuautitlán, Estado de México. 1 San Luis Potosí SLP. | Possible unavailability of the resource, with a medium probability of occurrence due to a decrease in rainfall. |

| Wastewater from another organization | Not Applicable | Not Applicable | Not Applicable |

| Tank truck water | Industrial (Production, ancillary services and sanitary services) | 1 in Chalco Estado de México. | Possible depletion of the resource and a possible water deficit in the region. Likewise, extraction volumes are relatively low. |

| Wastewater from the organization itself | Industrial (sanitary services and irrigation of green areas). | 3 at the Herdez México Industrial Complex in Cuautitlán, Estado de México, México Distribution Center and Barilla Plant (2 at the Plant and 1 at the Distribution Centers). | México Manufacturing Plant, México Distribution Center and Barilla México recycled 84.9%, 100% and 75.2%, respectively, of their treated wastewater for landscape irrigation. |

Discharges

| Source | Discharge Method | Use of Discharge | Description of Related Impacts |

|---|---|---|---|

| Rivers and lakes | Por descarga directa al cuerpo de agua mediante canal de desagüe | En el canal lateral del canal Valle del Fuerte, Cuenca Río Fuerte, Afluente canal principal Valle del Fuerte Distrito de Riego 075, Región Hidrológica Sinaloa, Localidad El Fuerte, Sinaloa. | The discharge of wastewater is treated in accordance with applicable regulations; therefore, the level of significance of the impact on the receiving body has not been determined. |

| Seas and oceans | Not Applicable | Not Applicable | Not Applicable |

| Underground (wells) | By direct discharge to the water body by means of a drainage channel | Wastewater discharges from the Lagos de Moreno Plant, SLP Distribution Center, Té Manufacturing Plant and El Duque are sent to the county drainage system.

Wastewater discharge from the Celaya Plant and part of the Mexico Plant is discharged to a federal drainage system. 100% of México Distribution Center’s wastewater and 84.9% of Planta Mexico’s wastewater infiltrates into the soil. |

Wastewater discharges are treated in accordance with applicable regulations; therefore, the level of significance of the impact on the federal receiving body and/or infiltration into the subsoil, which are considered national assets, has not been determined.

Although the significance of the water discharged into county drainage systems has not been determined, it is very difficult to evaluate the impact because these drainage systems contain an infinite number of discharges from different origins and sources. |

| County network | By gravity and direct conduction to the drainage system or receiving body. | County drainage system. | Discharge of pollutants into the body recipient. Although the significance of the water discharged into county drainage systems has not been determined, it is very difficult to evaluate the impact because these drainage systems contain an infinite number of discharges from different origins and sources. |

| Storm water (collected and stored directly by the organization) |

By pumping | Stormwater is used for green areas and the surplus is sent to a drainage channel. | The consumption of stormwater avoids the extraction of drinking water from wells, so the impact is positive, although its significance has not been estimated. |

| Wastewater from another organization | Not Applicable | Not Applicable | Not Applicable |

| Tank truck water | By direct discharge to the body of water through a sewage canal | Wastewater discharges from the Nutrisa Plant are sent to the county drainage system. | Wastewater discharges are treated in accordance with applicable regulations; therefore, their level of significance has not been determined. |

| Wastewater from the organization itself | By gravity and direct conduction to drainage. | County drainage system. | Planta México recycled 84.9%, México Distribution Center 100% and Barilla México 75.2% of the wastewater they generate and treat, using it to irrigate gardens.

Although the significance of the water discharged into county drainage systems has not been determined, it is very difficult to evaluate the impact because these drainage systems contain an infinite number of discharges from different origins and sources. |

Note: The quality of wastewater discharges to receiving water bodies is monitored through compliance with the maximum permissible limits established in the corresponding Mexican Official Standards (i.e., mandatory technical regulations).

Basins from which water is extracted by the organization:

| Basin | Description of Related Impacts |

|---|---|

| Cuenca (Basin) Río Fuerte, Región Hidrológica (Water Region) Sinaloa, Localidades Campo 35, Ahome and El Fuerte, Sinaloa. | Extraction and Consumption:

Except for the Mérida Distribution Center, our Manufacturing Plants and Distribution Centers are located in Basins and Water Regions with high or very high levels of water stress, but the consumption of our facilities is very low. Discharge: Although the wastewater generated at the facilities of Grupo Herdez is treated prior to discharge, the generation and discharge of this treated wastewater represent a certain negative impact due to the emission of pollutants into county drainage systems and surface water bodies, despite being very small volumes of discharges. These impacts may not be as significant because a very large diversity of wastewater discharges from different sources and origins converge in the county drainage system. |

| Cuenca (Basin) Presa San José Los Pilares and Others, Acuífero (Aquifer) San Luis Potosí, Región Hidrológica (Water Region) Salado in San Luis Potosí. | |

| Cuenca (Basin) Laja, Acuífero (Aquifer) Valle de Celaya, Región Hidrológica (Water Region) Lerma- Santiago, Villagrán Guanajuato. | |

| Cuenca (Basin) Río Verde Grande, Acuífero (Aquifer) Lagos de Moreno, Región Hidrológica (Water Region) Lerma-Santiago, Lagos de Moreno, Jalisco. |

Related impacts

Water goals are established based on the water consumption and wastewater discharge indicators maintained for each facility. Currently, each facility identifies areas of opportunity in its processes and makes estimates on the potential savings that each can provide, and then proposes an achievable annual goal. These goals are not related to the local context of their locations.

Note: No analytical, holistic or in-depth approach is applied to identify potential impacts; rather, only the potential impacts that could be caused by the volumes of water consumption extracted from the sources and by the amount of pollutants present in the wastewater discharged to the different receiving bodies are considered intuitively.

IP-10. Percentage of renewable energy consumed in the organization

Total electric energy consumed by Grupo Herdez:

In KWh: 94,751,735

100%

Electric energy from clean sources (Renewable + Cogeneration):

In KWh: 68,770,646

72.6%

Wind energy:

In KWh: 46,934,531

49.5%

Cogeneration Plant Energy

In kWh: 21,836,115

23.0%

Non-renewable from CFE:

In KWh: 25,981,089

27.4%

305-7. Nitrogen oxides (NOx), sulfur oxides (SOx), and other significant air emissions

| Atmospheric emissions | 2022 (Tn) | 2021 (Tn) |

|---|---|---|

| NOx | 67.02 | 73.32 |

| SOx | 76.7 | 85.84 |

| POPs (persistent organic pollutants) | 3.58 | NA |

| VOC (volatile organic compounds) | 1.18 | 1.16 |

| HAP (hazardous air pollutants) | NA | NA |

| PM (particles) | 5.9 | NA |

| CO | 23.97 | 24.57 |

| PS | 2.95 | 3.12 |

| COT | 3.58 | 3.72 |

| SO2 | 75.95 | 84.97 |

| SO3 | 0.76 | 0.86 |

| Filterable PS | 5.9 | 6.75 |

| NMCOV’s | 0.04 | 0.05 |

The methodology used is that of direct determination using specific emission factors for each type of pollutant as recommended by the GreenHouseGas Protocol (GHGP) for emissions from both direct stationary and mobile sources.

To determine the emission factors to be used, we considered the provisions issued by the UK Department for Environment, Food and Rural Affairs (DEFRA), the US Environmental Protection Agency (EPA) and the Intergovernmental Panel on Climate Change’s (IPCC) 2006 Guidelines for National Greenhouse Gas Inventories, through the Mobile Combustion GHG Emissions Calculation Tools and the Stationary Combustion GHG Emissions Calculation Tools, which in turn can be consulted on the GHG Protocol Website.

On the other hand, although the data represents the Group’s concentrate, the estimate is based on specific data provided by each facility, considering the fuel consumption – measured directly in stationary and mobile sources of Grupo Herdez. Likewise, unit conversion factors based on the metric decimal system were used for the conversion from kilograms to tons.

305-6. Emissions of ozone-depleting substances (ODS)

Grupo Herdez does not produce, import or export CFC-11 (R-11), R-14 and R-22 substances.

The most commonly used refrigerants are R-410A, R-134A, R-407C, R-404A, R-507, R-147, R-427 and R-MO99, among others.

305-5. Reduction of GHG emissions

| Reduction of GHG emissions | ||

|---|---|---|

| (Tn CO₂ eq.) | 2022 | 2021 |

| Process redesign | 1,125.38 | 102.59 |

| Conversion and adaptations of equipment | 71.45 | 14.16 |

| Fuel substitution | 0 | 0 |

| Collaborator behavioral change | 0 | 0 |

| Savings actions in process equipment | 2,839.31 | 5,692.25 |

| Total | 4,036.14 | 5,089.00 |

Note 1: The gases included in the calculation were CO₂, CH4, N2O

Note 2: Reductions were presented in both Scope 1 and Scope 2.

Note 3: No base year has been defined as a means of comparison against the reduction reported in this year 2022.

Reductions occurred in both Scope 1 (direct -stationary and mobile sources-) and Scope 2 (indirect -only EE consumption from CFE sources-).

The data is obtained from direct measurements for both electricity and fuel consumption, which were reported by suppliers through invoices. All reported emissions were estimated using the emission factors corresponding to each type of energy.

- The information is obtained directly from the Manufacturing Plants and Distribution Centers, which in turn have internal records of their energy consumption in logs, invoices and internal controls through electronic or printed files, which are compared, complemented and integrated with the information on electricity consumption reported by the Energy for Preserves (EPC) department.

- Energy consumption is reported to the sustainability department through pre-established forms, which are sent by the Manufacturing Plants and Distribution Centers.

- The invoices for payment of electric energy and fuels used were taken from the invoices of each energy supplier.

- Energy consumption data in m3 and kwh are converted using nationally and internationally recognized emission factors.

- Electricity consumption for GHG emissions estimation was taken from CFE invoices.

- Emission reductions were estimated by comparing energy consumption per unit of production between 2022 and 2021, in addition to the emission reductions achieved through the Energy for Preserves (EPC) projects. The criteria for calculating the emission reductions was the consumption in m3 of fuel/Tn produced and kWh/Tn produced.